Contents:

Highlights include the largest online brokers suite of funds, including several mutual funds with zero management fees, and excellent tools for retirement planning. Merrill offers different accounts, including online brokerage accounts, retirement accounts, and guided investment accounts handled by Merrill’s financial professionals. The company’s investment products include mutual funds, retirement and IRAs, stocks and trading, ETFs, health and college savings accounts, fixed income, CDs, insurance, and annuities.

They also waive certain non-trading fees like deposit or withdrawal fees, which other providers usually charge. The firm’s founders, Vladimir Tenev and Baiju Bhatt, aim to democratize access to the financial markets by introducing inexpensive trading services. It should be noted that this broker has seen significant growth in its user base during 2020 following the pandemic retail trading boom.

Is there any other advice you’d offer someone who’s considering opening a brokerage account?

Charles Schwab is an advertising partner of The Ascent, a Motley Fool company. Ally is an advertising partner of The Ascent, a Motley Fool company. Bank of America is an advertising partner of The Ascent, a Motley Fool company. JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. The Motley Fool has positions in and recommends Bank of America and JPMorgan Chase.

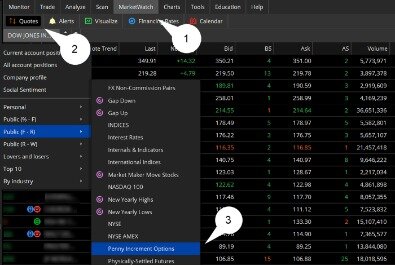

Service charges apply for trades placed through a broker ($25) or by automated phone ($5). See the Charles Schwab Pricing Guide for Individual Investors for full fee and commission schedules. Fidelity, a Boston-based company, has over $4.5 trillion in assets under management, which makes it one of the top firms by that criterion alone. The company is considered the best low-cost broker and the best broker for ETFs. Fidelity delivers value by not charging account fees; it has no minimum requirement to open a brokerage account, and it provides commission-free trades. They act as intermediaries through which customers can place buy and sell orders that are re-routed to the exchanges where the financial instruments are listed.

How to Find a Financial Advisor Near You

Q.ai is a newer automated brokerage where you choose a specific portfolio theme, and artificial intelligence takes care of the rest. Q.ai relies on a set of complex algorithms to choose the best stocks in each portfolio theme, called a Kit, making weekly portfolio adjustments to buy what the computers think are the best stocks in that category. Schwab offers a wide selection of investment products to help you build a diversified portfolio and reach your goals. There are many considerations when choosing the right online broker for your financial future. Just know that using an online broker gives you complete control over your investment journey. Charles Schwab may be your online broker option if you are looking for more hands-on support during your investing experience.

- This is where you can purchase stocks, bonds, ETFs, mutual funds, options and almost the entire inventory of the open markets.

- Robo-advisors, which are almost exactly what they sound like, are automated investment managers who handle administrative investment actions on your behalf.

- Additionally, the firm offers the possibility of trading cryptocurrencies, which is an alternative that not all providers in this list have made available.

- Is incorporated and begins making markets at the Paris Traded Equity Options Market and the Marché à Terme International de France futures exchange.

- While most trading platforms let you fund your account by linking a checking or savings account, there are a few that allow you to use alternate methods, such as a debit or credit card and digital wallets.

The E-Brokerage is capitalising on the country’s growing internet penetration. In Germany, ¾th of the population owns a smartphone, putting them eighth in terms of smartphone penetration. Between 2019 and 2020, the number of internet users in Germany increased by 307 thousand (+0.4%). Eighty-four per cent of the internet users’ access through smartphones.

The company’s scale has garnered a sizeable retail trading presence, and many have come to use the service for many of its free or low-cost trading features. E-Trade has three platforms, and all are free and have no minimum investment limit. As another service,E-Tradealso offers retirement planning to clients and in-person informational sessions annually in certain areas.

What to consider when choosing a broker

How this will turn out, only time will tell but it does seem that there will be a lot of eyes on the stock market when this finally does come to a conclusion. These investors ended up losing more than $38 billion in just 2020as shares rose more than 700%. Several online brokers often “gamify” their platforms to lure novice investors and promote frequent trading. While gamification features might seem appealing, it often drives less experienced investors to be swayed by the herd mentality in herd mentality, leading to significant losses when the hype dies down.

5 Best Online Brokers For Stock Trading of March 2023 – FinMasters

5 Best Online Brokers For Stock Trading of March 2023.

Posted: Wed, 08 Mar 2023 08:00:00 GMT [source]

Online brokers in the United States have to obtain a license to operate legally in the country. These are the most frequently asked questions regarding the best online brokers. The best services are those that respond positively when things don’t go as expected. Since your broker will provide custody of your money, having access to a representative from the company without having to wait hours by the phone or days for an email to be responded is the ideal situation.

TD Ameritrade’s Fee Structure

Chad Morris is a financial writer with more than 20 years experience as both an English teacher and an avid trader. When he isn’t writing expert content for Brokerage-Review.com, Chad can usually be found managing his portfolio or building a new home computer. IBKR conducts its broker/dealer business on over 150 market destinations worldwide and is headquartered in Greenwich, Connecticut with offices in multiple countries.

The best online trading platforms in Australia – Money magazine

The best online trading platforms in Australia.

Posted: Fri, 03 Mar 2023 08:00:00 GMT [source]

https://trading-market.org/ can also be traded with TradeStation for a $1.50 fee per contract for TS Select clients and $0.85 per contract for Premium. Margin rates start at 2.59% per year for IBKR Lite accounts under $100,000, and the rate goes down to 1.59% for IBKR Pro accounts. The rates are progressively diminished to as little as 0.75% for IBKR Pro accounts with a balance higher than $3 million. Interactive Brokers follows a tiered pricing structure, which means that the cost of trading with them varies depending on the volume. Finally, outgoing withdrawals cost $25 when made via wire transfer. Margin rates charged by this provider start at 8.95% for $10,000 or less, and are progressively reduced to 5.45% for account balances higher than $1 million.

Popularity of the best online brokers in the Netherlands

Many or all of the products featured on this page are from our sponsors who compensate us. This may influence which products we write about and where and how the product appears on a page. These partnerships may influence the products we review and write about , but they in no way affect our recommendation.

- 11 million customers and is considered one of the largest discount firms in the country.

- With continuous electronic liquidity provided by Timber Hill, the S&P 500 E-Mini futures becomes the first US electronic market and the most successful electronic futures contract ever introduced.

- Some firms are expanding their broker phone banks to increase availability of telephone trading at times of outage.

While there are many brokerage houses in the United States, the largest are companies like Charles Schwab and Fidelity. These are huge asset managers with millions of customers investing assets worth hundreds of billions of dollars. Before investing, it is important to understand the potential fee structure and the risk of loss.

This truly automates your investments if you set up recurring deposits, allowing your wealth to build. Free robo-advisory services, including goal planning and auto-rebalancing. Uses a social feed where members can share why they believe in certain companies (or don’t) and can post comments on others’ trades. If this sounds like an interestingmicro-investing app, open an account and make an initial deposit to see if the app meets your social and investing needs.

The company’s platform is easy to use, offering a wide range of tools and resources to help clients make informed investment decisions and it offers advanced tools for professional traders. Interactive Investor is a leading investment platform in the UK, known for being the top flat-fee provider. In May 2022, Interactive Investor was acquired by Abrdn plc so you might want to know how much it has as assets under management and how many clients they have. A deep discount broker handles buys and sales of securities for customers on exchanges at even lower commission rates than regular discount brokers.